No lengthy introduction, just the analysis results. I have one reminder: the term EU as used herein refers to Europe , or European Region, as defined in the BP review, and not European Union.

I refer readers to Part 1 for an introduction to the data bases, methods, abbreviation and definitions used in this series.

Europe’s production, consumption and net export trends: an ELM analysis

Figure 29 presents the reported production, consumption and calculated net exports rates (dark blue, bright red and dark green open circles respectively) and the corresponding nonlinear least squares analysis (NLLS) best logistic equation best-fit curves (solid lines with the same respective colors).

The best fit parameters of Qo, Q∞ and the rate constant "a" are summarized in Table 7 below:

Table 7 summary of best fit parameter for production and consumption for EU

| |||

Qo (bbs)

|

Q∞ (bbs)

|

a (yr-1)

| |

Production 1965-89

|

0.53

|

37

|

0.18

|

Production 1990-2011

|

14

|

72

|

0.14

|

Consumption 1965-1982

|

23

|

161

|

0.14

|

Consumption 1983-2011

|

159

|

539

|

0.043

|

As illustrated in Figure 29, EU’s annual production rate has been in steady decline since peaking at 2.54 bby in 2000. For instance, in 2011 production rates were 1.47 bby—a 42 % decline in 11 years, or, -3.8 %/yr. Of course, this reflects the continuing decline in petroleum production from the North Sea, mainly from Norway , UK and Denmark

The last two years of EU’s consumption rate has dropped more steeply compared to the early data. Therefore the NLLS best fit to the consumption data for 1983-2011 suggests consumption declining more steeply than the comparable analysis in Estimating the End of Global Petroleum Exports, Part 3, using the BP review data up to 2009. It looks like EU’s consumption rate peaked in 2006 at 6 bby. In 2011, the consumption rate was 5.4 bby—a 10% drop in 5 years.

The net export implication of these NLLS fits is represented by the difference curve shown as the dark green line: because domestic production is declining more steeply (e.g., about -3.8%/yr) than consumption (e.g., about -2%/yr), exports to EU would have to increase substantially in order to accommodate the gentle downwards red consumption rate curve. For instance, according to this ELM analysis, to support a consumption rate of 5.2 bby, EU’s net petroleum imports would have to be about 4.6 bby by 2018. With an estimated production rate of only 0.81 bby in 2018, that means that 88% of Europe ’s petroleum consumption would have to be imported. That’s a substantial increase in the already high 72% of Europe ’s petroleum consumption coming from imports in 2011.

Unfortunately, EU’s recent petroleum import and export trends do not support such a scenario at all. Rather, the triple combination of increasing petroleum exports from EU to other regions, decreasing petroleum imports to EU and decreasing domestic petroleum production rates, suggests a steep decline in consumption rates over the coming decades.

Predicting Petroleum Export Rates from EU to other Regions

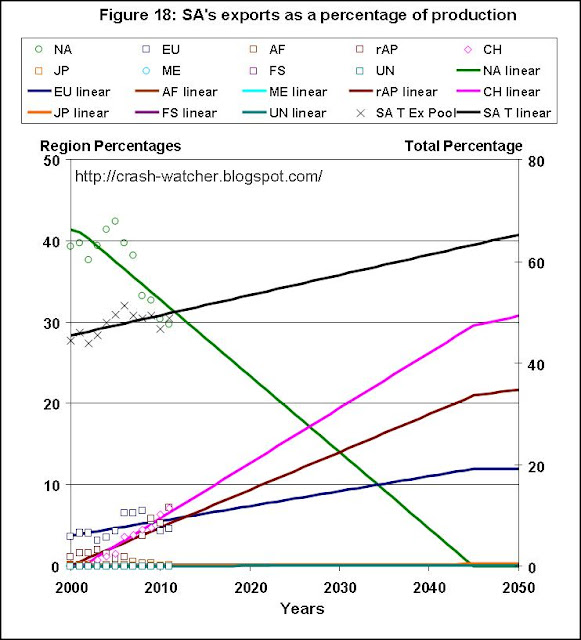

Figure 30 shows the relationship between petroleum production rates and export rates for EU, as already worked out in my previous study from a few months ago. This is actual the same as Figure 3 in Part 1 of “Relationship between Petroleum Exports and Production.”

The proportion of EU’s total exports, expressed as a percentage of production (black Xs, rhs scale), is surprisingly large and growing larger. Total exports are increasing at 1.7 %/yr (solid black line r2=0.88). For instance, in 2000, exports corresponded to 28 % of total production—and by 2011 that number was up to 51 %. Extrapolating this trend out to 2040 gives the surprising, and probably unrealistic result of 100% of EU's production being exports, although by, then EU’s domestic production is close to zero (0.03 bby according to the blue line in Figure 29).

What is going on here—why would a region like EU, whose domestic production is in such steep decline, continue to export ever-increasing proportions of its petroleum to other regions?

As I illustrated in Figure 8 of “Part 6: Inter-Regional Trade Movements of Petroleum to and from Europe ,” it is not so much that EU’s absolute exports have increased over the part decade. Rather, the absolute amount of exports have stayed about the same, during the steep decline in absolute production rates. Consequently, exports, as a percentage of production, has increased, as shown in Figure 30.

Still, why maintain your exports in the face of steeply falling production?

A clue to the answer lays in the fact that, as pointed out in Part 1 of “Relationship between Petroleum Exports and Production,” the proportion of EU’s exports as petroleum products has been increasing. Apparently EU has found value in processing its own crude oil production, and probably some of its crude oil imports, and re-exporting a portion of this, as petroleum products, to other regions. So then, could EU, by 2040, be exporting more than it products? Yes, maybe, if like Japan, it can still import crude oil, convert that imported crude into to petroleum products, use some of these products domestically, and the re-export the rest (see analysis for JP to follow in Part 8).

Looking at the individual export destinations for EU’s exports, NA is the primary destination, although this export trend seems to have turned around sharply after 2007, giving a flattening trend. The recent decline in exports to NA is counteracted by sharp increases in exports to AF (r2=0.75) and rAP (r2=0.56), with smaller trends for increases in exports to SA and JP.

Figure 31 shows the predicted absolute regional exports from EU to the other regions, based upon the combination of the production rate trends shown in Figure 29 and the export trend lines shown in Figure 30.

Going forwards, despite exports rates, as a proportion of production, going up as shown in Figure 30, the trend is for absolute exports to go down. That is, EU’s sharply declining production rate swamps out the increase export rate tread in the long run. Therefore, assuming these trends hold, absolute exports to NA will go down steeply over the next two decades, and exports to AF, rAP and SA will also decline but not as fast the decline in exports to NA. Still, after 2030, EU’s exports are predicted to be quite minimal at about 0.1 bby, mainly due to EU minimal production rate at that time.

Predicting Petroleum Import Rates to EU from other Regions

Figure 32 shows the sum (black line), and individual import contributions, predicted for each of the other eight regions, to EU.

Like NA, EU has a several times disparity between the total amount of petroleum exported (e.g., about 0.8 bby in the mid-2000s) and the total amount imported (e.g., peaking at about 4.8 bby in 2008). In fact, you might by surprised that absolute petroleum imports into EU are about 1 bby higher that absolute imports into NA (comparing Figure 32 to Figure 27 in Part 6).

Unlike NA, however, EU’s domestic production rate has been steeply declining for over a decade. Moreover, as illustrated in Figure 32, imports from two of EU’s biggest three suppliers have gone down (ME, bright blue line), or, have plateaued (AF, brown line) over the last decade. And, exports from ME and AF to EU are predicted to steeply decline over the next decade.

As I showed in Part 2 of this series (Figure 2 and 3) over the last decade, ME's petroleum exports overall have been in decline, and, these declining exports have been shifting away from NA, EU and JP towards rAP and CH. Moreover, over the coming decades, exports are predicted to further decline, as ME’s production rate declines.

As I showed in Part 4 (Figure 13 and 14), although AF’s overall exports have trended upwards, exports to EU are flat to trending downwards, and going forwards exports from AF are predicted to steeply decline due to steep declines in domestic production.

As I showed in Part 2 of this series (Figure 2 and 3) over the last decade, ME's petroleum exports overall have been in decline, and, these declining exports have been shifting away from NA, EU and JP towards rAP and CH. Moreover, over the coming decades, exports are predicted to further decline, as ME’s production rate declines.

As I showed in Part 4 (Figure 13 and 14), although AF’s overall exports have trended upwards, exports to EU are flat to trending downwards, and going forwards exports from AF are predicted to steeply decline due to steep declines in domestic production.

It is mainly the increased imports from the FS over the past decade that has prevented EU from seeing an overall decline in its total imports, due imports from ME and AF flatteningg or declining. However, imports from FS to EU are also predicted to peak in about 2011-2012. As shown in Part 3, FS has started to shift its exports towards NA and CH, and going forwards, FS’s absolute exports are predicted to decline as it’s domestic production rate declines.

What this means for EU in the long term are steep declines in imports from its three main suppliers FS, ME and AF. For instance from 2012 to 2030 EU’s total imports are predicted to decline from about 4.7 bby to 1.4 bby—a 70 % percent decline. I find it interesting that EU’s imports are not predicted to go to zero mainly because of the long, slow, trend for NA’s production and exports to continue. For instance, as predicted in Figure 32, NA’s exports to EU eventually overtake FS’s declining exports to EU in about 2035. This trend might occur earlier if FS, as discussed in Pert 3, FS cuts back its exports in order to delay its own domestic consumption rate from going to zero.

Predicting Consumption Rates for EU based on the PIE analysis

Well, I imagine that by now, you can see the disaster prediction coming from the “triple whammy” of trends of decreasing domestic production and imports, and, increasing exports. But let’s go through the numbers.

I applied my normalization to EU in the same manner as done for NA, SA and AF. For EU, the average calculated consumption rate, based on the summation of production plus imports minus exports for the 2001-2011 time range, was 0.113 ± 0.181 bby higher than the reported consumption rate for EU as reported in the BP review. Therefore my normalization for EU consisted of subtracting 0.113 bby from the predicted future consumption rate and adjusting total net exports upwards by this same amount. And, like NA, SA and AF, I did not attempt to distribute this correction proportionally among the individual absolute exports and absolute import to and from each of the other regions.

Figure 33 shows the production, consumption and net export data, and corresponding best fit curves, the later two now shown as dashed lines. Added is the predicted net export (light green solid line representing total absolute exports minus total absolute imports plus the +0.113 bby correction) and consumption (blood red solid line) prediction curves, based on my PIE analysis (exports minus imports plus the -0.113 bby correction).

The results presented in Figure 33 suggest that if EU’s production rate follows the decline trend predicted by the logistic equation best fit (solid blue line), and EU’s export and import rates continue along the trend lines shown in Figures 31 and 32, respectively, then the predicted total net export rate curve (solid light green line) is not going to continue to grow more negative as suggest by the ELM analysis in Figure 29 or the dashed green line in Figure 33. Rather, EU’s net exports will become increasingly less negative—although they always stay negative. That is EU looks destined to stay as a net importer.

PIE analysis predicts a very steep decline in the domestic petroleum consumption rate for EU (solid blood red line)—even steeper than that predicted for NA in Part 6, and much steeper than that suggested by the logistic equation fit to the consumption rate data (dashed red line in Figure 33). For instance, according to the consumption rate decline predicted by the PIE analysis, EU’s consumption will go from its peak of 6 bby in 2006 to 1.35 bby in 2030—a 78 % decline or -32% per decade or -3.2% per year. That’s almost 1.5 times steeper that the consumption decline rate of -2.2 %/yr predicted for NA.

As I pointed out earlier, EU’s annual production rate has been drooping by about -3.8 %/yr and its annual consumption rate has been dropping by about -2 %/yr. I expect that the consumption rate decline will accelerate when, as discussed above, the imports from FS start to plateau and then decline, and as imports from ME and AF continue to decline. For instance, the predicted consumption rate for EU shown in Figure 33 (solid blood red line) suggests consumption declining from 5.27 bby in 2011 to 1.26 bby in 2031—a 3.8 %/yr decline rate.

Final thoughts

This analysis suggest that, even more than North America, Europe’s petroleum consumption rate and therefore its GDP are in for a very steep decline over the next two decades. If it was hard imagining how North America’s economy could grow in the face of a -2.2 %/yr decline in petroleum consumption, then it is even harder to imagine the same for Europe with a -3.2 %/yr to -3.8 %/yr decline rate in consumption.

With a consumption rate of about 5.4 bby and population of about 0.6 billion, Europe in 2011 had a per capita petroleum consumption rate equal to about 9 barrels per person per year (bpy). Now consider the prediction of a consumption rate of 1.26 bby in 2031 and of 0.8 bby in 2040 (from Figure 33). This is quite troubling. Even if Europe ’s population just stays about the same, this would mean a per capita petroleum consumption rate of 2.1 bpy in 2031 and 1.3 bpy in 2040, whcih is lower than the 2011 per capita rate of consumption of about 4 to 5 bpy for South America or the former Soviet Union, or, even China’s 2011 per capita rate of about 2.5 bpy.

At least for North America, there was some suggestion of a light at the end of 20 years, in that it could become a net exporter of petroleum. This does not seem likely for Europe, because it primary petroleum resource, North Sea Oil, has been in decline for the last decade, and I see no signs in the data of this being mitigated. If the trends shown in this analysis continue, Europe will become somewhat like Japan, being almost totally dependent upon foreign sources of oil, mainly from the former Soviet Union and North America .

--------------------------------------

Next time, I will turn my attention to Japan